If you’re planning to take a home loan or any property-backed loan in Bangalore, you have probably heard about the mortgage deed.

At first glance, it might seem like confusing legal paperwork, but it serves as a formal legal document that ensures protection for both the borrower and the lender.

Bangalore’s property market is fast-moving, and the rules around mortgages and registrations can feel tricky. That’s why it’s important to get everything right from the start, especially since mistakes or missing paperwork can cause delays or legal problems later.

This guide covers everything you need to know about mortgage deeds in Bangalore, from the different types of mortgages to the process of drafting, registration, and accessing expert assistance

What Exactly Is a Mortgage Deed?

Mortgage deed is a legal agreement between you and the property owner seeking a loan, and the lender, typically a bank or financial institution. It confirms that your property is being pledged as security for the loan process in India.

- If you pay off your loan on time, the property stays yours.

- If you don’t, the lender has the right to take legal action and might end up selling your property to get back their money.

Who’s Involved in This Agreement?

- Mortgagor: That’s you — the property owner borrowing money.

- Mortgagee: The lender giving you the loan.

- Registrar or Sub-Registrar: Government officials who record (register) the mortgage deed to make it official.

Types of Mortgages – What You Should Know

Different loans use slightly different types of mortgages. Here’s a quick, friendly explanation of the most common types you might hear about when dealing with properties in Bangalore.

| Type of Mortgage | Who Keeps Possession | When Lender Can Claim Property |

| Simple Mortgage | Borrower | On default, through court sale |

| Mortgage by Conditional Sale | Borrower (till default) | On default, lender becomes owner |

| Usufructuary Mortgage | Lender | Lender enjoys rent/profits till repayment |

| English Mortgage | Lender (ownership transferred) | Ownership remains with lender until repayment |

| Equitable Mortgage (Deposit of Title Deeds) | Borrower | On default, lender enforces rights through court |

| Anomalous Mortgage | Depends on agreement | Depends on contract terms |

When Do You Need a Mortgage Deed in Bangalore?

Here are the most common situations where a mortgage deed becomes mandatory in Bangalore:

Getting a home loan from a bank or NBFC:

Bangalore residents can secure home loans from top banks and NBFCs to purchase residential properties in the city. Loan eligibility, interest rates, and tenure depend on income, credit history, and property value, making it easier to finance your dream home in Bangalore.

Taking a loan against property (often called LAP):

A Loan Against Property (LAP) lets you use your existing property in Bangalore as collateral to raise funds. This option is ideal for personal expenses, business expansion, or other financial needs without selling your property.

Refinancing an existing property loan:

Refinancing a property loan in Bangalore helps homeowners replace their current loan with a new one at lower interest rates or better repayment terms. This reduces EMIs and can free up funds for other investments or financial goals.

Using your property as collateral for business loans:

Businesses in Bangalore can leverage owned properties to obtain business loans for working capital, expansion, or new ventures. Using property as collateral allows access to higher loan amounts with easier approval.

If you’re an NRI involved in property loans in Bangalore:

NRIs investing in Bangalore real estate can access home loans and LAPs, following RBI regulations. Banks provide tailored solutions with flexible repayment options and NRI-friendly processes, making property investment in Bangalore smooth and convenient.

What Should a Mortgage Deed Include?

Here are the key things a mortgage deed must clearly state:

- Property details: Exact address, survey numbers, size, and boundaries.

- Loan amount and interest rate: How much you’ve borrowed and the interest charges.

- Payment schedule: When and how you’ll repay the loan.

- Right of redemption : Your right to repay the loan and get the property back.

- Terms if you don’t pay: What actions the lender can take.

- Stamp duty and registration details: Legal charges as per Karnataka’s rules.

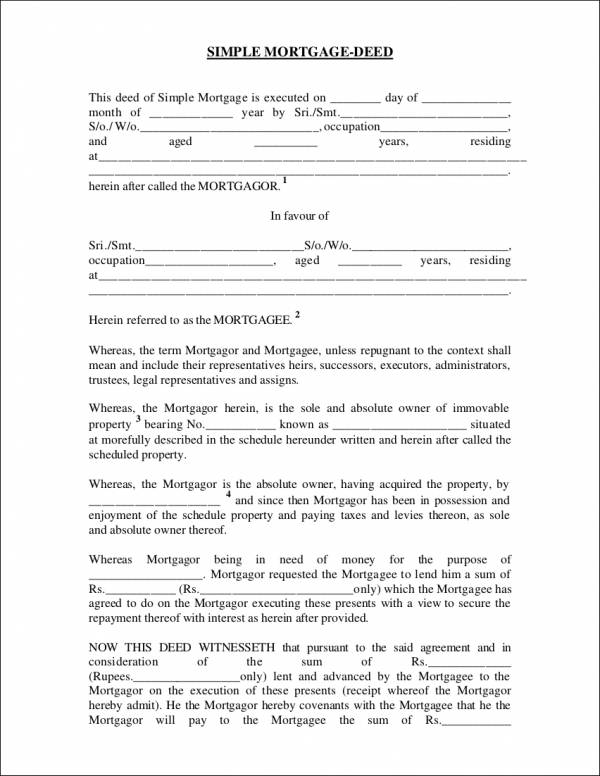

Illustrative Reference: Sample Mortgage Deed

How to Draft a Mortgage Deed Legally in Bangalore

Simple Guide to Drafting Without Errors

- Get expert guidance: Talk to a local property lawyer or a reliable mortgage deed drafting service in Bangalore. They will guide you through the process and ensure all Karnataka-specific rules are followed.

- Collect required documents: Gather all property papers and ID documents before starting. This includes:

- Draft the deed: Use a legal format approved by Karnataka’s registration office. Your lawyer can customize it depending on whether it’s a bank loan or a private loan.

- Buy correct stamp paper: The stamp paper value depends on your loan amount and Karnataka Stamp Act rates.

- Review carefully: Confirm all details are accurate and that both you and the lender fully understand the terms.

- Prepare for registration: Once reviewed, get the deed ready for submission to the registration office

Registering Your Mortgage Deed in Bangalore

Step-by-Step Guide

If you want to avoid the hassle of multiple steps and the risk of errors or delays, our team can handle the entire process for you — just get in touch with us.

- Go to your local Sub-Registrar office in Bangalore.

- Submit required documents: Drafted mortgage deed, ID proofs, property papers, and loan agreement.

- Pay stamp duty and registration fees: Usually between 2–5% stamp duty plus around 1% registration fee.

- Complete biometric verification: Thumb impression and photo.

- Registration is done: You’ll receive a registered copy of the mortgage deed.

Canceling a Mortgage Deed in Bangalore

Once you’ve repaid your loan fully, you need to cancel the mortgage deed. This is done by:

- Drafting a “Deed of Discharge” (also called Mortgage Release Deed).

- Getting a No Objection Certificate (NOC) or clearance from your lender.

- Registering the discharge deed at the Sub-Registrar office as per similar steps you took originally.

What Will This Cost You?

| Service Type | Estimated Cost Range |

| Stamp Duty | 2% to 5% of the loan/property value |

| Registration Fees | Around 1% of property value |

| Legal/Consultant Fees | ₹5,000 to ₹25,000+ depending on complexity |

| GST | Applicable on legal services |

Always ask before you start so you know the breakdown and avoid surprises.

Frequently Asked Questions (FAQs)

Do I have to register my mortgage deed in Bangalore?

Yes. Registration is required to make it legally valid and enforceable.

Can I draft a mortgage deed myself?

Technically yes, but mistakes can cause big issues. It’s best to hire a local expert.

How long does the registration process take?

Usually 1-2 weeks if all documents are ready.

How do I cancel a mortgage deed later?

File a Deed of Discharge with the sub-registrar after you clear your loan.

What documents do I need for mortgage deed registration?

Drafted mortgage deed, loan agreement, property papers (sale deed, EC, RTC), ID proofs, and tax receipts.

Ready to Take the Next Step with Proplex?

Handling mortgage deeds can feel complicated, but with Proplex, you don’t have to do it alone. Our team of verified property consultants and legal experts in Bangalore ensures your mortgage deed registration is smooth, accurate, and hassle-free.

If you’re taking a property loan in Bangalore, don’t risk costly mistakes. With Proplex, your paperwork from drafting and document verification to registration and cancellation is managed professionally, saving you time and stress.

Your property and peace of mind deserve expert care. Choose Proplex for mortgage deed registration in Bangalore and secure your loan process without delays!

Leave a Reply